The power of the voice is something we’ve always championed within our solutions. It’s proven on many occasions to be the most effective medium for outcome-focused engagement and communication. But are live calls always necessary where collections are concerned?

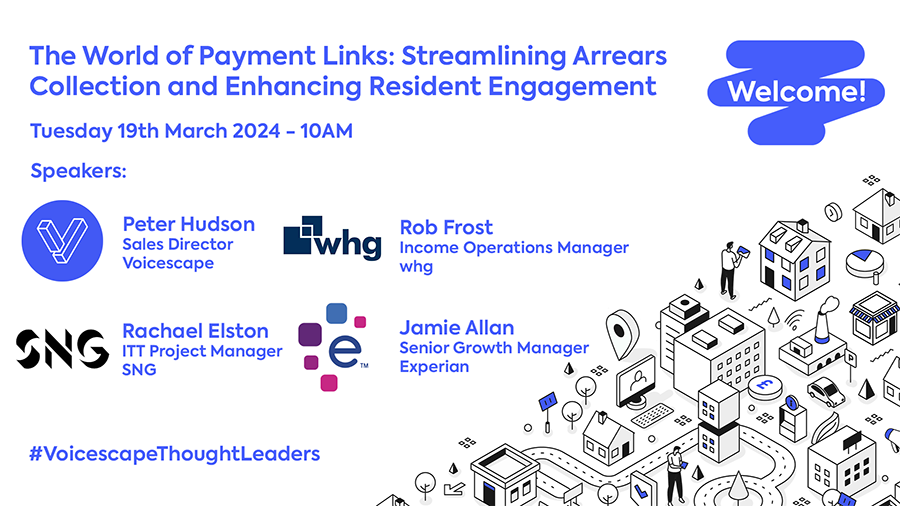

On 19th March we sat down with some of our customers to not only unpack the potential of self-serve payment links, but also to showcase how intelligent integrations with Voicescape automation can supercharge your investment and boost collections.

The win-win of self-serve

Achieving the best outcomes for your teams and tenants requires a considered combination of voice, text and mail – each suited to different stages of the customer journey. While later-stage escalations and individuals in need of support may require a human touch, those making routine transactions, like regular rent payments, often don’t. Yet, we frequently see contact centres and income officers inundated with calls for these non-value exchanges.

In many of these cases, the customer won’t want to speak to another person, while the operator’s time could be better spent dealing with repairs or other complex cases. Self-serve payment link providers such as allpay, PayPoint and Pay360 address this issue. By giving customers a pre-populated link, they can make payments quicker and easier – boosting the collections process, freeing up capacity and improving the customer experience.

The automation effect

While payment link technology offers clear organisational and customer benefits, housing associations need effective ways to communicate links en masse to their communities – a whole new challenge in itself without a streamlined approach. That’s where Voicescape comes in.

By listening closely to our customers , we identified an opportunity to create intelligent integrations between two best-in-class technologies: the efficient self-serve capabilities of payment links, and the engagement-focused automation of Voicescape’s solutions like Engage and Collections. Ultimately, by combining two already powerful components, we are building something greater than the sum of its parts.

In an exclusive partner webinar, we invited guests from whg, Experian and SNG (formerly Network Homes) to demonstrate their experiences of using such an integration. The intention was to help more organisations supercharge their investment, boost collections and improve tenant engagement. Here are some key stats and takeaways…

Rob Frost, Income Operations Manager at whg

whg are a housing association based in Walsall and faced many challenges around collections and sustaining tenancies, so they wanted to make it as quick and easy as possible for customers to make a payment.

Following their success with Voicescape Engage, they experienced an influx of inbound calls. However, many of these were just to make a routine payment. So, in May 2022, they gave the green light on an allpay-Voicescape integration, harnessing the power of pay-by-link within their Engage communications. The solution was live after just five days, and the feedback since has been overwhelmingly positive for whg and have been able to:

- Embed payment amounts and reference numbers have empowered customers to pay wherever and whenever

- Provide a QR code option provides ease of access on all correspondence

- Enable Income officers to be proactive with tailored and timely messages for things like Universal Credit payments

- Reduce contact into the business has created more capacity for complex cases and has boosted team morale

- Collected £764,215 through 3,581 pay-by-link transactions

- Reduced rent arrears by 0.04% in the 12 months after implementation – a period where they actually predicted an increase given the economic climate

Jamie Allan, Senior Partner Manager at Experian

Experian is a global information services organisation and the custodian of data on over 1.5 billion people. The team works with a lot of local authorities and housing associations providing data support in areas from financial crime to tracing customers. And it’s the latter where Voicescape and Experian have combined to integrate automated engagement for FTA cases with the fast trace solution, Supertrace.

Many housing associations often find it hard to chase FTA cases due to changed contact details and addresses. Experian can gain rapid access to these new details and, via the Supertrace application, automatically reprocess Collections cases with updated details – no manual input required. Here’s some feedback from this streamlined solution:

- Revenue is generated as a result of updated details without intervention needed

- Seamlessly reconnecting with customers has reduced time spent working on trace cases and helped build relationships with customers

- In a recent use case for a client, we ran data for a list of 400 tenants with uncontactable details and Supertrace came back with around 600 new phone numbers

Rachael Elston, ITT Project Manager and Dione Somerville, Leasehold Income Manager at SNG (formerly Network Homes)

Sovereign Housing Association and Network Homes have now come together as SNG (Sovereign Network Group). Before using Voicescape, Network Homes had just one income officer managing FTA and two to three officers managing CTA. Understandably, they found it challenging to maintain the necessary volume of contact required to keep arrears down.

In December 2022, they began using Voicescape Collections for their FTA debt to help boost the process and free up their officer’s capacity, followed by CTA debt in May 2023. In the time period from implementation to February 2024, the same amount of income officers collected the following amounts:

- FTA – £192,000 from one officer using Voicescape two to three times a week

- CTA – £465,000 from two to three officers using Voicescape twice a week

Following these startling results, SNG will implement Voicescape Collections for their leasehold team, where they will also take advantage of our integration with PayPoint’s pay-by-link technology. They will send automated calls with the voice of an income officer, giving tenants the option to be sent a PayPoint link by SMS or speak to an officer – empowering customers to choose their method should they need further assistance. SNG look forward to being able to maximise income, improve the customer experience, free up capacity, and ultimately sustain tenancies.

Drive engagement and boost collections with Voicescape

Results taken from live polls during the webinar showed that almost all attendees were using a payment provider. Meanwhile, most attendees felt their payment provider was either moderately integrated or wasn’t integrated well with their current engagement process. Given that the effectiveness of payment links has proven to be significantly heightened by the integration of automation, this reflects a huge opportunity for the sector to supercharge its tenant engagement processes around arrears management technology investment.

Check out the full replay here: www.info.voicescape.com/paymentprovider-webinar-lp

To find out more about how we can help you infuse automation with your current payment process, get in touch with our friendly team today.

-2.png)